Greta Thunberg Has the Climate Alarmists’ Number

If they believed what they claim to believe, they’d do a lot more about it. She’s right—how dare they?

How to think about Greta Thunberg?

She is the 16-year-old Swedish environmental activist known for her articulate fulminations on climate change. At last month’s United Nations General Assembly, she scolded delegates. “I shouldn’t be up here,” she said, her expression contorted with rage. “I should be back in school on the other side of the ocean. Yet you all come to us young people for hope. How dare you? You have stolen my dreams and my childhood with your empty words. And yet I’m one of the lucky ones. People are suffering. People are dying. Entire ecosystems are collapsing. We are in the beginning of a mass extinction, and all you can talk about is money and fairy tales of eternal economic growth. How dare you!”

It’s true that political causes discredit themselves by allowing children to make arguments they don’t understand. But ridiculing a child, however cynical her promoters, is dishonorable. I vividly recall the vicious mockery from supposedly responsible adults when Caitlin Upton mangled an answer about geography in the 2007 Miss Teen USA pageant. The spectacle of grown men ridiculing a well-meaning 18-year-old girl wasn’t an appealing one.

Commentators who sympathize with Ms. Thunberg’s views are perceptibly conflicted about whether they should champion her activism or wish she’d go away. You sense the uncertainty in center-left punditry about her. She gets praise for her bold preaching on climate change, which the right can’t criticize without appearing boorish—great. But a political movement spoken for by a teenager can’t be taken altogether seriously.

Yet Ms. Thunberg has a lesser-noted claim on our attention—not her expertise or her degree of alarm, but her insight into the global climate-change movement itself. She is aware—and has the bad manners to say so—that the vast majority of wealthy transnationals who intone rote demands that governments “take action” on climate change don’t actually believe what they’re saying.

At the U.N., Ms. Thunberg wasn’t speaking to rubes and oilmen and climate “deniers.” She was speaking to the swarms of diplomatic elite who had earlier disembarked from jumbo jets and descended on Midtown Manhattan’s bars, restaurants and five-star hotels and clogged its streets with phalanxes of giant sport-utility vehicles. Ms. Thunberg appears to suspect—rightly—that these people don’t think we’re headed for doomsday. They enjoy the moral uplift afforded by their fashionable views; otherwise they’re along for the ride.

Young children don’t see hypocrisy for what it is. They have faith in adults. When Ms. Thunberg was younger and she heard European politicians and leaders of nongovernmental organizations insisting that the world would experience cataclysmic environmental degradation unless governments imposed dramatic changes, she believed them. She couldn’t have understood that when the leaders she admired spoke of taking “dramatic” and “immediate” action to combat climate change, all they had in mind was the incremental transfer of political power to unaccountable regulatory agencies and transnational organizations in faraway capitals.

According to her family’s 2018 book, “Scenes From the Heart,” young Greta persuaded her parents to forgo air travel (despite her mother’s dependence on it for her career as an opera singer) and to become vegans. She cut classes to engage in protests outside the Swedish Parliament. But most “climate leaders,” she would discover, weren’t prepared to make significant changes to their life aims for the sake of preserving life on Earth. For them, it was enough to toss their empty water bottles into the recycling bin and maybe buy a Tesla.

They could argue with impeccable logic that there’s no point in making major changes to your lifestyle, since real progress requires that developed and developing nations all agree to huge decreases in carbon emissions. That, as everybody at the U.N. must know even if they pretend not to, will never happen: No national government can be expected to cripple its economy on the dubious promise that other nations will cripple theirs. So our climate leaders are happily reduced to making piecemeal demands for more regulatory powers—most of which will have no appreciable effect on global climate.

Ms. Thunberg grasps that if today’s climate leaders believed what they claim to believe, they would use their power to impose drastic reductions to greenhouse emissions, whatever other nations might do. They would also, if their convictions were genuine, engage in terrible and revolutionary deeds for the salvation of humanity: intimidation, brutality, sabotage. Instead they are content to trumpet the right opinions and otherwise persist in their ordinary habits of consumption as though none of it really mattered. Greta Thunberg has a point. How dare they?

Mr. Swaim is an editorial page writer for the Journal.

Greta Thunberg is right: It’s time to haul ass on climate change

Economically and politically, early ambition is better.

When Swedish climate activist Greta Thunberg addressed the elites assembled at the World Economic Forum in Davos, she concluded with a simple message: “I want you to act as if our house is on fire.”

For those elites, it was unfamiliar language. They are accustomed to talking about climate change, but typically such talk amounts to ritual invocations of “urgency” coupled with promises about what might be achieved in 2030 or 2050.

When your house is on fire, though, you don’t promise results in a decade or a year or a week. You grab a bucket and find some water. Immediately.

When it comes to climate policy, Thunberg has it right. We are in a unique historical moment; we understand the danger of climate change and, for now, still have the resources and political space necessary to address it. But every second of delay makes the challenge more expensive, more difficult, and more dangerous.

It’s not just climate activists saying that. The policy community is moving in that direction as well, with similar arguments coming into clearer view from economists and political scientists. The common theme is risk, and what it means to take the mounting risks of the climate crisis seriously.

Let’s start with economics. The conventional climate policy recommendation from economists has been to start with a low carbon price and ramp up slowly, but a recent paper in the Proceedings of the National Academies of Science (PNAS) flips that view on its head, urging instead an aggressively high price, starting now. The arguments are worth unpacking.

The conventional story from climate economics may get it backward

Mainstream climate economics has always had a simple story to tell, based on a simple fact about climate change: The damages get worse as time passes. The damages today are fairly low, which means the amount of money worth spending to avoid them is fairly low. As the damages rise, the amount worth spending to avoid them will rise. What’s more, we value losses today more than we value losses in years hence; we “discount” future benefits and losses.

Discount rates: A boring thing you should know about (with otters!)

Together, these yield the conventional policy recommendation from economists, for decades now: a relatively low carbon tax that rises steadily over time. That basic structure goes at least back to economist William Nordhaus and is echoed in virtually every carbon tax ever proposed, including the most recent, the bipartisan Market Choice Act introduced in the House in July. (It would start at $24 a ton and rise at 2 percent plus inflation.)

But there is a growing counter-narrative among economists who claim that the standard picture gets it backward. Climate economic models have been trying to price damages when they should be pricing risk.

Financial economists understand risk better than climate economists

This new thinking found clear voice last week with the appearance of the PNAS paper “Declining CO2 price paths” by Kent Daniel of Columbia Business School; Bob Littleman, a financial analyst; and Gernot Wagner, an economist at NYU.

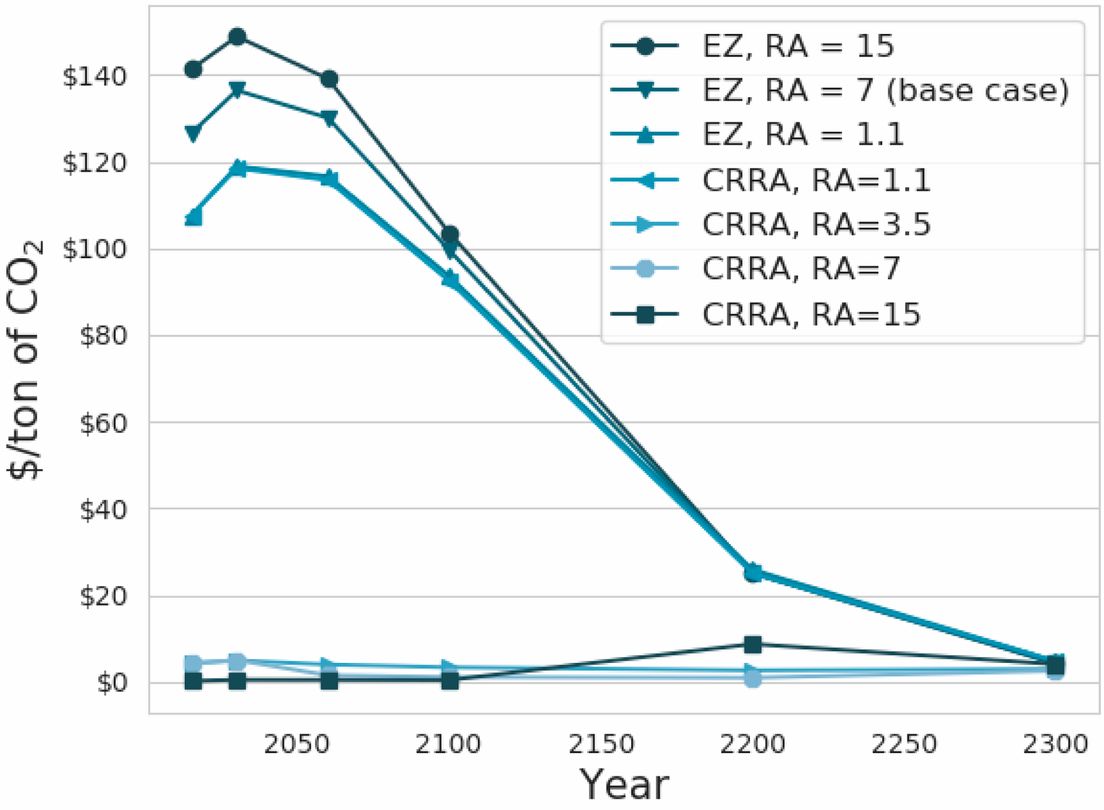

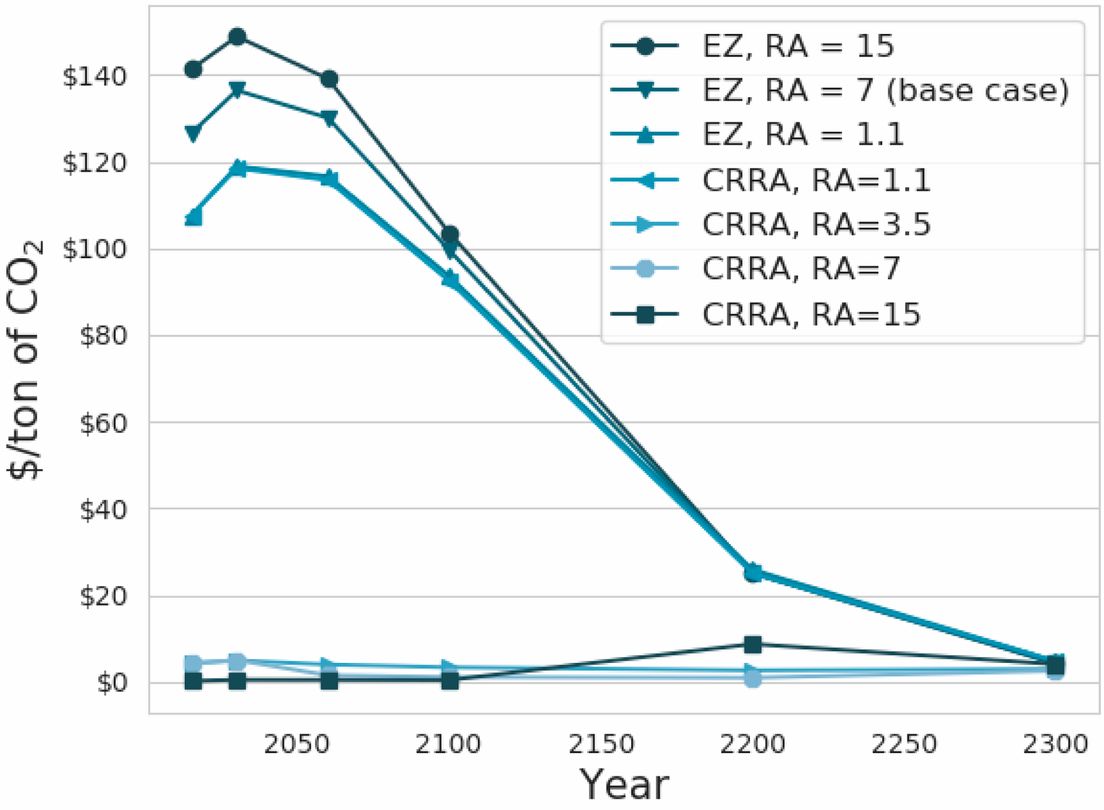

It argues that a properly calibrated carbon tax would start high — over $100, possibly toward $150 — rise for a decade or so, and then begin declining. That’s virtually the opposite of conventional wisdom.

The key is thinking like a financial economist, the sort of person who bets on businesses and markets. Financial economists know a lot about decision making under conditions of uncertainty. They are not so arrogant as to believe they can make “optimal” investments. Optimality requires perfect knowledge, and knowledge of market trends and fluctuations is, to say the least, imperfect. So financial economists learn to think in terms of risk, how to value it and hedge against it.

However, as Daniel, Littleman, and Wagner (DLW) argue, “important insights from pricing financial assets do not typically inform standard climate-economy models.” Much of the modeling in climate economics seeks to determine the ideal carbon price based on a particular damage function — “a knob-twiddling exercise in optimizing outcomes,” as the great economist Martin Weitzman once put it. (Weitzman, who died recently, was a mentor of Wagner’s and is a huge influence on the counterinsurgency in climate economics.)

DLW approach CO2 as an asset with negative returns and build a model based on financial economics: “EZ-Climate, a simple recursive dynamic asset pricing model that allows for a calibration of the carbon dioxide (CO2) price path based on probabilistic assumptions around climate damages.” DLW are not the first to use this kind of model — here’s a review of recent research — but their model is simpler, more modular, and easier to adapt.

Many equations later, two strong conclusions jump out.

Two economic arguments for urgent action

First, while the model produces a range of outcomes — like all such models, it is sensitive to various choices of inputs and parameters, and there’s no “correct” carbon price — in all cases, the carbon tax starts high and declines. How high? It ranges, but in almost no case was it less than $100 a ton.

Why so high? The cost of risk overwhelms everything else, and risk is extremely high right now.

One of the key factors in risk is uncertainty. We know that somewhere out there, at some temperature, there are tipping points at which biophysical processes that drive warming will become self-sustaining. (The ice melts, the blue water absorbs more heat than the white ice did, more ice melts.) They will enter rapid phase shifts that drive warming beyond any human ability to rein it in. In short order, geologically speaking, the Earth’s climate will become inhospitable to large mammals like us.

What level of warming might trigger those tipping points? We have only the faintest idea.

There are “tail risks” like this all around climate change. We think they are unlikely, but we don’t really know how unlikely, and the stakes could quite literally be existential.

High uncertainty times high stakes equals high risk, exactly the kind of risk that requires substantial hedging. That’s why the model starts the price high.

The price declines over time for two reasons. First, uncertainty resolves itself; people will know more in 2050 than we do today. Alongside that, technology improves and costs fall, making mitigation easier.

The second clear result from the modeling is that the cost of addressing climate change rises rapidly every year of delay:

In rough monetary terms, delaying implementation by only 1 y costs society approximately $1 trillion. A 5-y delay creates the equivalent loss of approximately $24 trillion, comparable to a severe global depression. A 10-y delay causes an equivalent loss in the order of $10 trillion per year, approximately $100 trillion in total.

When we do not spend the money to hedge against risk, risk mounts, at enormous financial cost.

One important implication of this model: It serves to justify early climate policies around the world that economists often derided as expensive, like Germany’s solar feed-in tariffs or Norway’s electric-car subsidies. Those policies translate to extremely high prices on carbon.

But from the perspective of prudential risk management, the problem has not been those “expensive” policies. The problem has been that there aren’t a lot more of them.

The political argument for immediate, aggressive action

The economic argument is bolstered by a political argument with a similar structure.

In the case of climate change, we know the old saw applies: An ounce of prevention is worth a pound of cure. Preventing climate change through mitigation is much cheaper than adapting to a changed climate. Every bit we prevent is a bit we don’t have to adapt to. And mitigation spending is more egalitarian, more just — everyone on Earth benefits from it — whereas adaptation spending is inevitably local and skewed to those with more wealth and resources.

A just solution to climate change crucially hinges on maxing out near-term mitigation spending.

However, just as there is a danger of climatic feedback loops, there is a danger of what Peter Howard and Michael Livermore (of NYU and UVA Law Schools respectively) call, in a recent Harvard Law Review paper, “sociopolitical feedbacks.”

As climate damages mount and countries begin dealing with more heatwaves, floods, and storms, continued investment in sustainable alternatives will become more difficult. Adaptation spending will rise relative to mitigation spending.

Along with this “economic disruption pathway” is a “political disruption pathway.” Howard and Livermore review the literature on the connection between climate change and civil conflict, along with the connection between civil conflict and participation in international treaties, and raise the danger that “climate change-induced conflict may make countries increasingly unable or unwilling to take the steps necessary to prevent even worse outcomes in the future.”

Climate change will primarily manifest as a series of traumas, and as a general matter, stress and trauma cause people to draw their circles of concern inward. Yet addressing climate change requires a circle of concern that encompasses all of humanity. It requires international cooperation. And the escalating damages of climate change are likely to make the very cooperation necessary to fight it more difficult. Local concerns and fears will come to dominate.

Sociopolitical feedbacks are as difficult to predict as biophysical feedbacks — we are just as ignorant about how close they may lie — but they are just as dangerous. Prudence suggests acting aggressively while coordinated action is still possible.

“Humankind is wasting a short window of opportunity to address climate change,” Howard and Livermore warn, “one that may soon shut as climate damages incapacitate effective political action.”

The best way to hedge against these gathering risks is to act immediately and aggressively to transition away from fossil fuels to sustainable energy, transportation, agriculture, and industry, spending whatever is necessary along the way.

Every year the countries of the world put off that transition, they pile more risk onto the shoulders of their children and grandchildren. How dare they.